Contact Us

Office: 083 000 1000

Studio: 083 00 00 967

Telegram: 083 00 00 967

WhatsApp: 083 00 00 967

Telegram: 083 00 00 967

WhatsApp: 083 00 00 967

Location: Unit 42 & 44, Hyper Motor City, Maxwell Street, Windhoek, Namibia

Listeners:

Top listeners:

Radiowave 96.7FM

play_arrow

play_arrow

Actor and Idol: Dating Done Right Lunch w/ Yanika

todayFebruary 24, 2025

Don’t worry, we forgot too…. but there is still time to get your ducks in a row before Friday. To complete provisional tax in Namibia, you need to follow a series of steps. Below is a step-by-step guide to help you through the process:

Don’t worry, we forgot too…. but there is still time to get your ducks in a row before Friday. To complete provisional tax in Namibia, you need to follow a series of steps. Below is a step-by-step guide to help you through the process: Step 1: Understand Who Needs to Pay Provisional Tax

Provisional tax in Namibia applies to individuals or businesses who earn income that is not subject to withholding tax (e.g., self-employed individuals, businesses, or freelancers). If your income exceeds a certain threshold, you are required to pay provisional tax.

Step 2: Register with the Namibian Revenue Agency (NamRA)

Before making provisional tax payments, you must be registered with NamRA. You can register online or visit a NamRA office to complete your registration. Ensure you have a tax identification number (TIN).

Step 3: Determine Your Provisional Tax Payments Schedule

Provisional tax is paid twice a year (semi-annually). There are two payment periods:

For individuals or businesses with fiscal years that differ from the calendar year, adjustments are made to align with their financial year-end.

Step 4: Estimate Your Taxable Income

Estimate your taxable income for the year, including income from all sources such as employment, business, and investment. If you expect to make a profit from your business or other sources, calculate how much tax you might owe based on your estimated income.

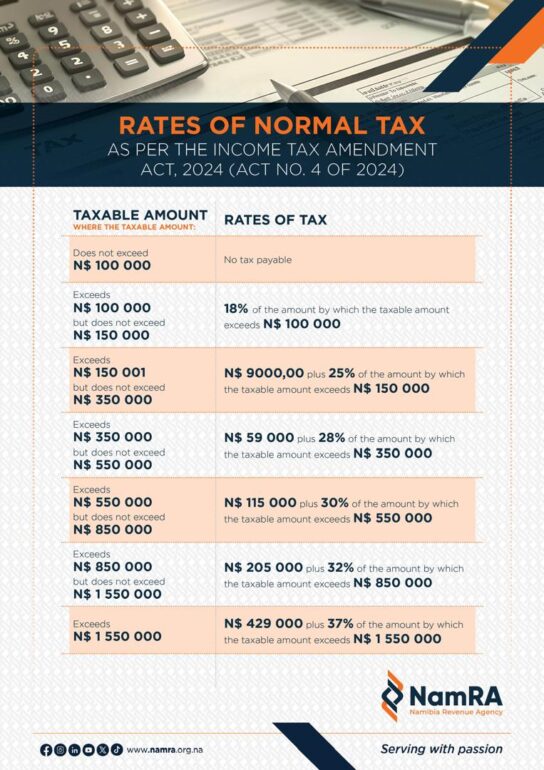

Step 5: Calculate Your Provisional Tax

Use the tax tables provided by NamRA to calculate the amount of provisional tax you owe. You may want to consult a tax professional or use NamRA’s online calculators to ensure accurate calculations.

Step 6: Submit Your Provisional Tax Return (Form TPT 002)

You must submit your provisional tax return on the prescribed form (TPT 002) to NamRA by the payment deadlines:

You can submit the return online through NamRA’s eFiling platform or manually at a NamRA office.

Step 7: Make the Payment

After submitting your provisional tax return, pay the calculated provisional tax amount by the due date (31st August and 28th February). Payments can be made through bank transfers or at NamRA’s designated payment points.

Step 8: Final Tax Assessment

At the end of the tax year (usually 31st of March), you will need to file a final tax return (Form TPT 003) to reconcile the provisional payments with your actual income. If you have overpaid, you can claim a refund; if you underpaid, you will need to pay the outstanding balance.

Step 9: Keep Records

Keep records of all income, deductions, and tax payments, including receipts for provisional tax payments, for future reference or in case of an audit by NamRA.

It’s always a good idea to consult with a tax professional to ensure that your provisional tax submissions are accurate and comply with Namibian tax laws.

Not sure if you qualify for Tax? Here is a breakdown:

Written by: Madeline

COPYRIGHT 2025 Radiowave 96.7FM | WEBSITE BY DIGITAL PLATFORMS